EPS 95 Pension Hike 2025: Here’s All to Know about Hiking EPS Pension to ₹7,500

EPS 95 Pension Hike 2025, EPS Pension latest News today, status, EPS 95 pension News today 2025: Indian private sector employees often face financial difficulties due to lower retirement benefits. However, the upcoming Budget 2025 might bring some relief, as there are expectations of an increase in the Minimum EPS-95 Pension to ₹7,500, including Dearness Allowance (DA). Several discussions and meetings have been conducted, and various reports on the internet suggest potential changes aimed at enhancing retirement support benefits.

If you are also struggling with inadequate retirement funds, this update could be crucial for you. Understanding the expected changes in the 2025 EPS-95 Pension Amount will help you stay informed and prepare for upcoming financial adjustments. Stay updated with the latest developments to ensure you make the most of any benefits introduced in the new budget.

EPS-95 Pension 2025: Latest Updates on Pension Revisions

Recent discussions have taken place regarding potential changes in the EPS-95 Pension Scheme for employees contributing to the Employees' Provident Fund Organization (EPFO). As per reports, representatives of EPS-95 pension holders have met with Finance Minister Nirmala Sitharaman to propose an increase in retirement benefits. This move is aimed at providing better financial security to pensioners.

With rising inflation and increasing financial burdens, the expected modifications to the EPS-95 pension plan could bring significant relief to a large section of retirees. If approved, these changes would ensure that pension holders receive a minimum pension of ₹1,000 per month, helping them manage their daily expenses more effectively.

This article covers key details about the EPS-95 Pension 2025, including eligibility criteria, expected policy changes, and other relevant updates from the latest discussions. Stay informed about how these proposed revisions may impact pensioners and their financial stability in the coming years.

8th Pay Commission Salary Increase Notice - PDF Download

Short Details in EPS-95 Pension Hike 2025

| Scheme Name | EPS-95 Pension 2025 |

|---|---|

| Country | India |

| Department | Ministry of Labour and Employment |

| Beneficiaries | Eligible pensioners |

| Minimum Pension | ₹1,000 per month (expected) |

| Official Website | labour.gov.in |

| Latest Notice | Updates awaited |

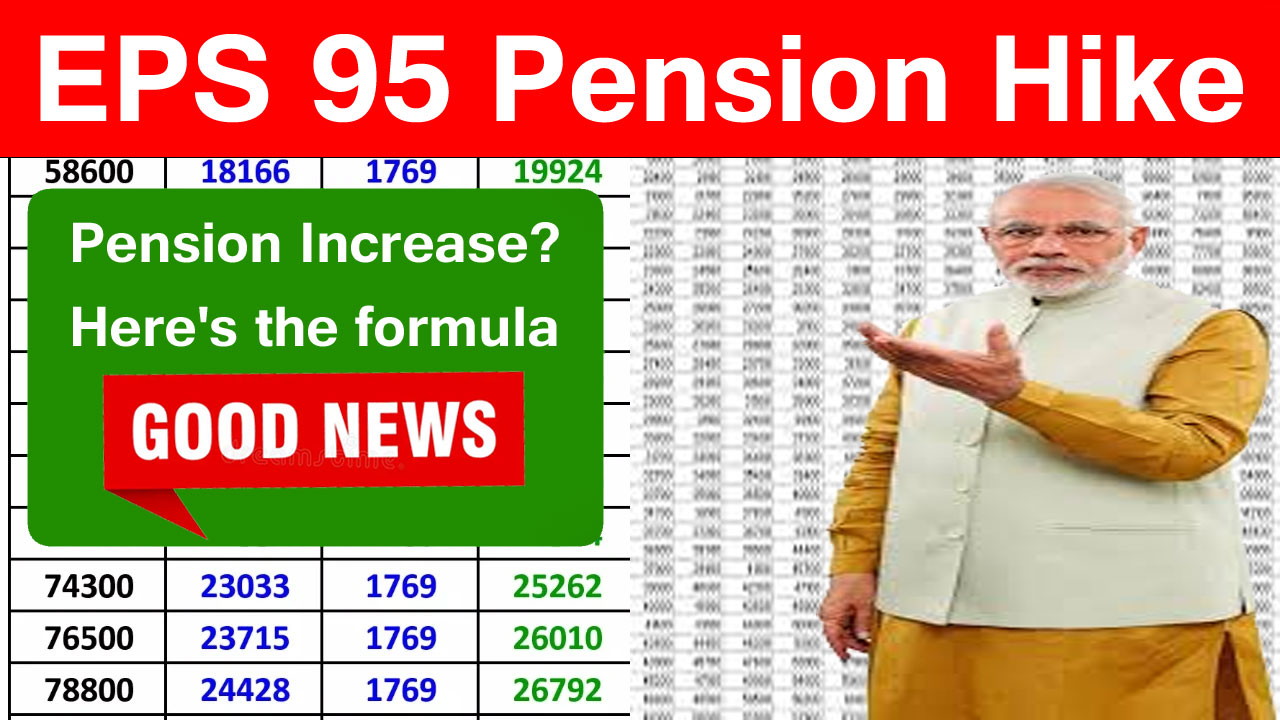

Expected Changes in EPS-95 Pension 2025

- Increase in Minimum Pension – The government may raise the current pension amount, ensuring better financial security.

- Higher Retirement Benefits – The scheme may introduce enhanced benefits for long-term contributors.

- Inflation Adjustment – Pension calculations might be revised to keep up with rising inflation.

- New Guidelines for Eligibility – There could be modifications in the eligibility criteria for pension benefits.

Eligibility for EPS-95 Pension

To qualify for the EPS-95 pension, an individual must meet the following conditions:

- ✔️ Must be an EPFO member and have completed at least 10 years of service.

- ✔️ Should have attained the age of 58 years for full pension benefits.

- ✔️ Employees who retire early (before 58 years) can claim a reduced pension.

How to Check EPS-95 Pension Updates?

- Visit the official website labour.gov.in.

- Look for the latest notifications and announcements regarding EPS-95 pension changes.

- Pensioners can also visit EPFO offices or check updates via their employer or pension disbursing bank.

EPS-95 Pension Eligibility

The Employees' Pension Scheme (EPS-95) provides a monthly pension to eligible individuals who have contributed to the Employees' Provident Fund Organization (EPFO). Many Indians are interested in this scheme as it ensures financial stability after retirement. Below are the key eligibility criteria for availing of the EPS-95 Pension in 2025:

Indian Residency & Organized Sector Employment:

- The applicant must be a resident of India.

- They must have been employed in an organized sector and contributed to the EPFO.

Minimum Contribution Period:

- A minimum of 10 years of contribution to the Employees' Pension Scheme is mandatory to qualify for the pension benefits.

Age Criteria:

- The standard pension age is 58 years. Applicants become eligible for the regular EPS-95 pension at this age.

- An early pension option is available from the age of 50 years, but the pension amount may be reduced as per the scheme’s guidelines.

By meeting these eligibility conditions, individuals can secure their monthly pension benefits under EPS-95.

Understanding EPS-95 Minimum Pension

Employees in the organized sector are entitled to a minimum pension of ₹1,000 per month under the EPS-95 scheme. This pension aims to provide financial support after retirement, helping retirees manage their daily expenses and reduce financial stress. To qualify for this benefit, employees must meet specific eligibility criteria and contribute to the Employees' Provident Fund Organization (EPFO) during their working years.

The last revision of the minimum pension amount took place in 2014. Since then, no further updates have been made, despite rising inflation, which has significantly reduced the purchasing power of pensioners. Due to this, pensioners' associations and representatives are urging the Finance Minister to consider their request for an increase in the minimum EPS-95 pension from ₹1,000 to ₹7,500 per month. If approved, this revision would provide much-needed financial relief to elderly pensioners, ensuring they can meet their basic needs more comfortably.

What is New EPS-95 Demand?

Representatives of EPS-95 pensioners recently held a meeting with Finance Minister Nirmala Sitharaman, urging the government to raise the minimum pension amount under the Employees' Pension Scheme (EPS-95) to ₹7,500. The Finance Minister acknowledged their concerns and assured that the request would be reviewed to enhance retirement benefits for employees in the organized sector.

Commander Ashok Raut, President of the National Agitation Committee (NAC), conveyed the demand on behalf of pensioners. During discussions, representatives highlighted the financial struggles faced by elderly pensioners due to inadequate pensions, which are insufficient to cover basic necessities amid rising inflation.

In addition to the proposed increase in the minimum pension amount, pensioners have also requested medical benefits for themselves and their spouses to help manage healthcare expenses. The government is expected to consider these demands while working on pension reforms.

Whatsapp Join Hare

EPS-95 Current Situation 2025

Currently, EPS-95 pension holders receive a minimum pension of just ₹1,000 per month after retirement. However, this amount is widely considered insufficient to meet daily expenses, leading to financial difficulties for pensioners. As a result, there is a growing demand for significant reforms to increase the minimum pension amount, ensuring better financial security and dignity for retirees.

EPS-95 pension benefits provide a basic financial cushion, but the existing ₹1,000 pension is inadequate to cover essential living costs. Recognizing this issue, Ashok Raut has stated that the current minimum pension amount does not allow retirees to sustain themselves with dignity. He emphasized the need for the government to address this concern in the 2025 budget by increasing the minimum pension. If implemented, this reform could significantly enhance the welfare of retired employees, providing them with greater financial stability and reducing the risk of poverty.

This proposed increase in the EPS-95 pension is seen as a crucial step in improving the quality of life for pensioners and ensuring their well-being in post-retirement years.

Trade Union on Lower EPS-95 Pension Increase

Following the pensioners' demand for a minimum monthly pension of ₹7,500, trade unions have put forth a lower proposal, suggesting an increase to ₹5,000 per month. This proposal aims to help pensioners meet their daily expenses but has drawn criticism for being insufficient.

The EPS-95 National Agitation Committee has strongly opposed the trade union’s suggestion, arguing that ₹5,000 would not be adequate to cover even the basic needs of pensioners. Many have expressed disappointment, stating that a higher pension is essential for a dignified livelihood.

EPS 95 Pension Hike 2025 PDF Download Links

| EPS 95 Pension Hike 2025 | Click Hare |

| EPS 95 Pension 2025 Website | Click Hare |

| EPS Pension Calculator | Click Hare |

EPS 95 pension status, EPS 95 pension latest News today, EPS 95 pension news today 2024, EPS 95 Pension login, EPS 95 Pension Hindi, EPS 95 pension News today 2025, eps-95 pension online apply, EPS 95 Pension latest News today in Hindi, EPS 95 Pension Hike 2025: Here’s All to Know about Hiking EPS Pension to ₹7,500

Comments Shared by People