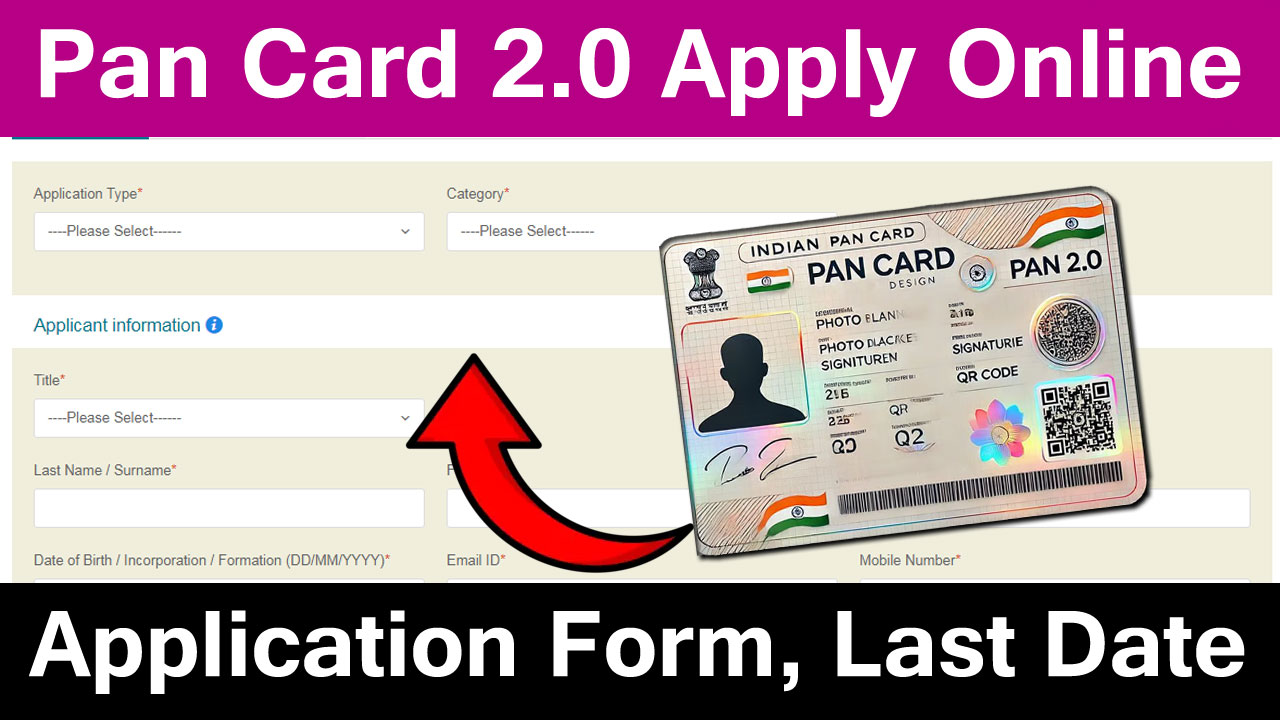

Pan 2.0 Apply Online – Registration, Application Form, Last Date

Pan 2.0 Apply Online, Pan 2.0 Registration, Application Form, Last Date: Several websites that provide information about the Government of India and the Income Tax Department have introduced PAS 2.0, a digital version of the PAN card. This advanced system ensures secure data storage, enhances accessibility, and streamlines the application and verification processes.

The process for applying for PAN 2.0 online is simple, and all the necessary steps are outlined in this guide. Applicants can receive a free e-PAN directly via email, while those opting for a physical PAN card can obtain it for a nominal fee.

From the benefits of PAN 2.0 and the latest eligibility criteria for a new PAN card in 2025 to the step-by-step application process, this comprehensive guide covers everything you need to know.

Pan 2.0 Apply Online

PAN 2.0 is an upgraded version of India’s traditional Permanent Account Number (PAN) system, designed to enhance digital integration, efficiency, and security. This improved system introduces advanced features such as streamlined verification processes, faster e-PAN issuance, and better integration with financial institutions. Its primary goal is to simplify online transactions, reduce fraud, and improve tax compliance. Additionally, PAN 2.0 facilitates seamless Aadhaar linking, making the process more convenient for both individuals and businesses. Eligible users can apply for PAN 2.0 online and obtain their new Permanent Account Number with ease.

With PAN 2.0, authorities can monitor financial transactions more effectively, thereby reducing tax evasion and enhancing financial transparency. AI-driven authentication ensures higher accuracy and faster processing, minimizing errors in the system. Real-time updates and verification eliminate delays in PAN-related services, offering users a seamless experience. This initiative aligns with India’s vision for a digital economy, reinforcing the nation’s commitment to modernization and business-friendly policies.

New PAN Card 2.0 Registration 2025

| Name of Program | New PAN Card 2.0 Registration 2025 |

|---|---|

| Year | 2025 |

| Country | India |

| Department | Income Tax Department |

| Government | Indian Government |

| Category | PAN Card Apply |

| Benefit For | Eligible Indians |

| Official Website | www.pan.utiitsl.com |

New Pan Card Eligibility Criteria 2025

To be eligible for a new PAN card in 2025, applicants must meet the following criteria:

- Provide valid proof of date of birth (DoB), address (PoA), and identity (PoI) as per the prescribed guidelines.

- Individuals who require a PAN for taxation or financial transactions in India must submit the necessary documents as per government regulations.

- Minors can have a PAN card applied for by their parents or legal guardians, who must provide their own identification documents along with the child’s birth certificate.

- Existing PAN holders do not need to reapply for the updated QR-enabled PAN 2.0—it is available for immediate use.

Step-By-Step Guide To Apply Online New Pan 2.0

Follow these simple steps to apply for a new PAN card online:

- Visit the official website of UTIITSL or NSDL.

- Under the Services section, select “New PAN” to apply for a fresh PAN card or “Update/Correction” if you need to modify an existing PAN.

- Carefully fill out the application form. Before submitting, review all details at least twice to avoid errors.

- An OTP (One-Time Password) will be sent to your registered mobile number or email address for verification.

- Upload the required documents, such as Aadhaar, proof of address, and other necessary identification documents (if applicable).

- Once the application is successfully submitted, you can download your e-PAN card using the registered email address.

PAN Card 2.0 Features

The new PAN system, PAN 2.0, introduces advanced features to enhance security, efficiency, and usability.

- Unified Platform: All PAN and TAN-related services will be available on a single platform for seamless management.

- QR Code Integration: This feature will help prevent fraud and misuse of PAN details by ensuring enhanced security.

- Universal Identification: PAN 2.0 will serve as a single ID across all government systems, reducing the need for multiple documents.

- Simplified Management: Users will find it easier to handle PAN-related tasks with the upgraded system.

- Paperless Processing: The digital approach will lower operational costs and reduce environmental impact.

- Secure Data Storage: PAN information will be stored in a highly secure system to prevent data breaches.

- Enhanced Security Measures: Sensitive taxpayer data will be protected from unauthorized access through robust security protocols.

This new version of PAN aims to modernize the system, making it more secure, efficient, and user-friendly. 🚀

PAN 2.0 Application Form : Documents Required

The following documents are required for the new PAN card 2.0 application process.

- Proof Of Identity such as Voter ID, DL,Aadhaar Card and so on

- Address Proof(Utility Bill, Gas Pipeline Bill, Water bill)

- Passport Size Pic

Pan 2.0 Apply Online Links

| Pan 2.0 Apply Online Link | Click Hare |

| Pan 2.0 Download Link | Click Hare |

| Pan 2.0 Status Check Link | Click Hare |

| Pan 2.0 Application Form PDF | Click Hare |

FAQs On Pan 2.0 Apply Online

What makes PAN 2.0 different from the existing system?

PAN 2.0 offers a completely online and paperless process, integrating all PAN and TAN-related services into a single, unified platform.

Can I update my PAN details in PAN 2.0?

Yes, you can update details such as your name, date of birth, email address, and address using Aadhaar-based online services, free of cost.

Where can I update my PAN details?

You can update your PAN details through the NSDL PAN service or UTI PAN service websites using Aadhaar authentication.

Will older PAN cards without QR codes still be valid?

Yes, older PAN cards remain valid. However, PAN 2.0 includes dynamic QR codes that enhance usability and security.

Is there a fee for applying for a new PAN under PAN 2.0?

Applying for a new PAN, updating, or correcting PAN details is free. However, there is a fee if you request a physical PAN card.

Comments Shared by People